Starting a small business might seem easy, but there are also factors to consider, small business owners and their financing. Legitimately overseeing your small business financing stabilizes your company and makes your trade less likely to fail. To oversee your trim business financing options, make any doubts about paying yourself, keep the great line of credit, screen your books and arrange ahead. Business loans subsidizing little business finances implies intriguing expenses nearby reimbursements, whereas value financing avoids intriguing but may come with less control over your company affairs. This article is for trade business owners searching for exhortation on overseeing their company’s financial decisions. Managing accounts can be day-to-day operations for any little commerce business. Frequently, your little trade is effective because of the ability to pay interest to make your item or give your benefit. In case you don’t have a part of involvement with overseeing trade finances, it can feel like a chore, and you’ll be slipping into awful money-related propensities that might one day hurt your business line.

Business Financing Options

Unless your small business cash flow has the adjusted sheet of Apple, you may need to get capital through online or multiple lenders in the long run. Indeed numerous large-cap companies routinely look for capital implantation to meet short-term commitments. For little businesses, finding a good financing show is fundamentally critical. Take cash from the wrong source, have business debt, or discover yourself bolted into reimbursement terms that impair your development for a long time into a long-standing time.

Managing Small Business Tips

Here are some things you ought to do as a bit of trade small business owner to remain on the beat of your accounts.

Paying Yourself

“Small business that needs to proceed to develop personal assets, enhance and draw in the leading workers demonstrate that they are willing to contribute for a funding circle in the future,” he said. “Customers will appreciate the expanded level of benefit. Angel investors will appreciate your contribution to the business and their careers. And eventually, you may make more esteem for your commerce than if you were fair investing all your benefits on economic development.”

If you’re running a small business, it can be simple to undertake and put everything into day-to-day operations. After all, that additional working capital can frequently go a long way in making a difference in your business development. Alexander Lowry, a teacher and chief of the ace of science in budgetary investigation program at Gordon College, said business owners shouldn’t overlook their bad credit part within the business and should compensate themselves appropriately. You must guarantee that your commerce and individual accounts are in great shape.

Leverage Good Credits and Loans

As your business develops, you’ll need to buy a wholly-owned subsidiary, obtain extra protection arrangements and take out more interest rates. With bad credit history, getting endorsement for all these loan terms and acquisitions can be more troublesome. To keep strong credit, pay off all your obligation subsidizing as before long as conceivable. For illustration, don’t let your trade business credit cards run a balance for more than some weeks. Moreover, don’t take out advances with interest rates that you simply can’t manage. As it was looking for financing merely can rapidly and effortlessly reimburse.

A working capital loan can be frightening. They can lead to stressing personal finances and repercussions that go with disappointment. Be that as it may, without the deluge of working capital you get from good credit, you’ll face substantial challenges when attempting to buy gear or develop your group. You’ll moreover utilize credit to boost your cash stream and, in this way, confront fewer issues paying workers and providers on time.

Good Billing Strategy

If you have got inconvenience sparing for your quarterly payment terms, make it a month-to-month debt financing instep, said Michele Etzel, proprietor of Bayside Accounting Administrations. That way, you’ll be able to treat charge installments like several other months to months’ working costs.

Each small business owners feature a client that’s reliably late on its solicitations and installments. Overseeing little small business loan accounts implies managing the cash stream to guarantee your business is working at a sound level on a day-to-day premise. If you’re battling to gather from specific clients or clients, it may be time to induce incentives with a term loan.

Plan Ahead for a Good Financial Habit

Building up inside the application process for funding options, if it’s as straightforward as committing a set time to audit and overhaul budgetary data, can go a long way in securing the startup funding wellbeing of your trade. Keeping up with your loan accounts can assist you in mitigating competitive terms. There will continuously be self-funding issues that ought to be tended to nowadays, but when it comes to your loan options, you wish to arrange for the longer term.

“Small business administration, we are frequently strapped for time, loans and have unfathomably second rate innovative capabilities, but it shouldn’t avoid any business assets from executing a few sort of inner control,” Collado said. “This is particularly vital in case you have got workers. Frail inside controls can lead to representative extortion or burglary. They can get you into lawful issues if you or a representative are not tolerating certain laws.”

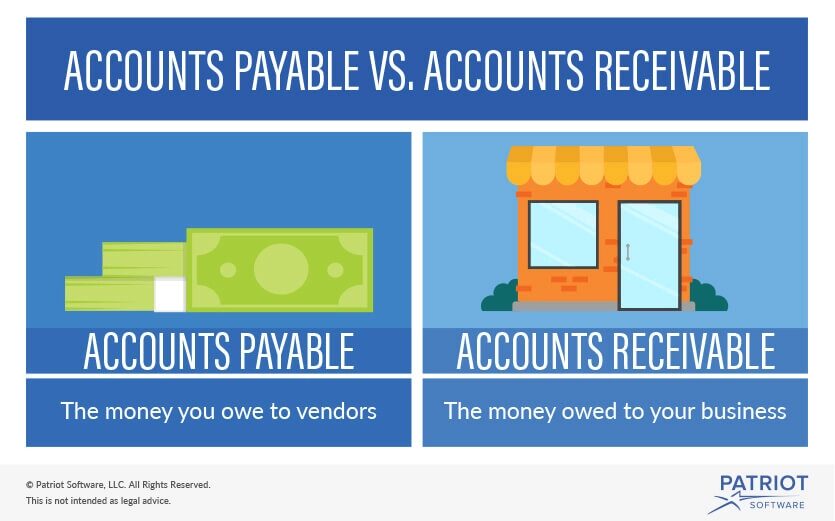

Accounts Payable vs. Accounts Receivable

In bookkeeping, disarray emerges when working between accounts payable vs. accounts receivable. The two sorts of accounts are exceptionally comparative in how they are recorded. Still, it is vital to distinguish between accounts payable and accounts receivable since one is a resource account, and the other could be an obligation account. Blending the two up can result in a need to adjust your bookkeeping condition, which carries over into your essential budgetary statements. It is imperative to note the importance of adjusting your resources and liabilities and stockholders’ value in bookkeeping. The noteworthiness of the adjustment can be clarified by the fundamental bookkeeping condition: Resources = Liabilities + Stockholders’ Value. One can moreover improve the condition to superior suit their inclinations.

What are Accounts Payable?

Accounts payable could be a current liability account that keeps track of the cash you owe to any third party. The third parties can be a traditional bank, a small company, or somebody you borrowed from your SBA loans. One common case of accounts payable is buys made for merchandise or administrations from other companies. Depending on the loan terms for reimbursement, the sums are ordinarily due quickly or within a brief period.

What are Accounts Receivable?

Accounts receivable may be a current resource account that keeps track of the cash that third parties owe you. Once more, these third parties can be banks, minority-owned businesses, or individuals who have SBA loans from you. One common illustration is the sum you owe for merchandise sold or administrations your company gives to produce income

Cash Flow Strategies

Cash flow is the money moving in and out of your small business administration. A positive cash flow implies you’re gaining more than you spend. Strategies for overseeing cash flow incorporate invoicing clients in a convenient mold, offloading stock that doesn’t offer well, and closely checking where you spend money. Experts prescribe securing financing sometime recently you’re strapped for cash and rebuilding installments to free up cash. This article is for a business owner who needs master counsel on overseeing the cash stream.

Budget Plan for your Small Business

Sometime recently, you’ll be able to focus on the budget. In any case, you would like to recognize what angles of your trade you’d like to improve. This will permit you to choose what can be done along with your stores. Based on that list, you’ll set up short-term and long-term goals. Your approach and active cash will straightforwardly influence these objectives. A short-term objective can be paying off an obligation or obtaining unused hardware.

Long-term objectives, like keeping aside promoting costs, are vital since they are associated with the general development of your business. You ought to be viable approximately the goals you set. They should be simply based on your business’s capacity to spend and spare. Once you have input your objectives, you’ll make a successful, secure budget by taking these steps.

Investing in Small Businesses

Business owners don’t know other affordable financing strategies besides business loan terms. Whether you’re considering contributing to an established business by buying into commercial real estate, there are typically only two positions you’ll take—equity (term loans for possession and benefits) or obligation (bank loans). Although there may be endless varieties, all venture sorts lead back to these two establishments.

For a long time, business owners or small business administration were more prevalent, although they give no security for the owners’ resources since proprietors are all in.

Equity and Debt Investment

As with numerous things in life and small businesses, there needs to be a more straightforward reply to this address. If you had been an early financial specialist in McDonald’s and obtained value, you’d be wealthy. If you had bought bonds (debt speculation), you’d have earned a not-too-bad return on your cash. On the other hand, if you purchase into a trade that comes up short, your best chance to elude unscathed is to possess the obligation, not the value.

All of usually encouraged and complicated by a perception that extremely popular esteem financial specialist Benjamin Graham made in his seminal work, “Security Analysis.” Namely, that value in commerce that’s SBA loans-free cannot posture any more noteworthy hazard than an obligation venture within the same firm since the individual would be, to begin with, in line with the capitalization structure in both cases.

How ROI Works in Small Business

On the off chance that a personal guarantee investment doesn’t have a great ROI, or if a speculator or business operates has other openings accessible with the next ROI, at that point, calculating the ROI values on the diverse openings can be taught them to which investments to select for the most excellent return. Many investigators and financial specialists like to utilize the ROI metric since of its flexibility and effortlessness. It works as a speedy gauge of an investment’s productivity, and it’s exceptionally simple to calculate and decipher for a wide assortment of speculation sorts.

ROI serves as a returns proportion regularly communicated as a rate, permitting a trade proprietor to calculate how productively the company employs its add-up to resource base to produce deals. Add up to resources and incorporate all current resources such as cash, stock, and accounts receivable in expansion to settled resources such as the plant buildings and gear.

Incentives for your Employee's Small Business

To guarantee representative maintenance and fulfillment, any small business needs to offer the best small business loan arrangement. This lets representatives know that their work inside small business lenders is esteemed, and if they exert the effort it takes to go over, and past their work desires, they will harvest the benefits.

A worker reward arrangement will precisely lay out what representatives are compensated for and when. For illustration, numerous representatives may get motivational rewards when they hit breakthroughs inside their company (e.g., after 6 months, 1 year, etc.) or if they total extra targets. There are numerous sorts of motivating force rewards and reward plans that can increment your employees’ engagement together with your organization. Depending on your company’s existing foundation, you will wish to offer one particular worker reward or a combination of a few

7 types of incentives for your employees

- Incentive compensation – If workers accomplish their execution goals, they may be entitled to a motivating force stipend in expansion to their existing base compensation. This sum payable is ordinarily sketched out in an employee’s contract at the start of their business.

- Annual incentives – If you’re looking to extend representative maintenance and remunerate workers, advertising yearly motivations is a great strategy for ensuring that employees adhere together with your company long term. These motivations can include a representative reward arrangement concurred upon at the start of their contract or be based on worker execution driving up to their commemoration in your company.

- Referral bonuses – Drawing in and holding great workers can be challenging – hence, fulfilling representatives who allude to unused enlists may be an exceedingly attainable choice for selecting the proper individuals. Advertising recompense for an unused contract isn’t as if it were a way of finding extraordinary unused representatives – it can offer assistance with worker maintenance.

- Sales commissions, or variable pay – When a deals worker meets or surpasses their objectives, a deals commission (or variable pay) can be advertised as an execution remunerate. As a rule, this frame of recompense is paid out at a rate of deals volume, as is concurred between the representative and trade proprietor when they are contracted.

- Holiday bonuses – During the occasion season, numerous little trade proprietors may elect to offer an occasion reward as a “thank you” for their employees’ difficult work during the calendar year (around 52% of businesses advertised occasion rewards in 2014). The extra sum granted is ordinarily based on a small rate of the employee’s general compensation or the sum the representative would receive within two weeks.

- Hiring bonuses – As an included liven for joining a company, little trade proprietors may offer an extra reward for being part of the group. This spurs important unused enlists to select their company over others competing for their engagement.

- Profit-sharing plans – Ordinarily best known among little to medium-sized businesses, a benefit-sharing arrangement will grant representatives recompense comparable to or around a company’s quarterly or yearly benefits rate. These benefits are frequently tied into the company’s yearly income and can be dispersed as commitments to an existing arrangement (e.g., a retirement arrangement) or as a cash stipend.